IVC | ZAG High-Tech Capital Raising Report: 2018 Marks All-Time Record as Israeli High-Tech Companies Raise $6.4 Billion in 623 Deals

09.01.2019 | IVC Research Center

Key facts:

- Six-year consecutive growth in Israeli high-tech capital raising—120% more compared to 2013

- Five financing rounds, each over $100 million, captured 13% of the annual amount

- VC-backed deals totaled $4.7 billion in 2018—number of VC-backed deals dropped first time since 2014

- Sluggish investment activity of Israeli VC funds—lowest since 2013

Tel Aviv, Israel, January 9, 2019. In 2018, Israeli high-tech companies raised $6.4 billion in 623 deals, marking a record following six years of the consecutive growth. The total capital raised in 2018 was 17% higher compared to 2017, but a remarkable 120% higher compared to 2013. The number of deals decreased slightly in 2018.

During Q4/2018, Israeli high-tech companies raised a record $1.82 billion, an increase of 8% compared to Q3/2018. The number of deals in the last quarter—140—was lower compared to Q4/2017 with 163 transactions.

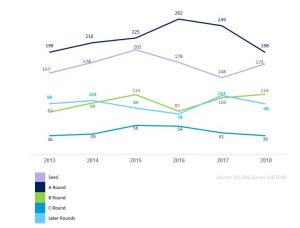

Chart 1: Israeli High-Tech Capital Raising 2013-2018

Capital Raising by Deal Size and Type

The number of deals below $5 million continued to shrink in 2018, while deals above $20 million kept growing. According to IVC’s analysis, the amounts of larger deals almost quadrupled from 2013 to 2018, seizing 63% of the total amount in 2018. The number of smaller deals (below $5m) has declines by 23% since 2015.

Q4/2018 saw an all-time record of 34 deals over $20 million each. Those larger deals raised a total of $1.3 billion in Q4 and $4.1 billion in 2018 due to five mega deals: Landa Corp. ($300m), Jfrog ($165m) Insightec ($150m), Trax ($125m), eToro ($100m).

In 2018, VC-backed deals totaled $4.7 billion, however, the number of VC-backed deals dropped for the first time since 2014 to 327 transactions. The average of VC-backed deals soared to $14.4 million in 2018, almost double from 2014 and 36% higher than 2017 average.

Capital Raising by Round Series, Sectors and Selected Clusters

For the first time since 2015, IVC data has noted an increase in the number of seed financing deals, 175 in 2018. Following a decrease of 27% in seed deals from 2015 to 2017, they increased 18% in 2018. Investors’ preference to focus on fewer deals drove down the median seed round to $0.68 million, while other median financing rounds more than doubled in 2013 – 2018.

Chart 2: Israeli High-Tech Capital Raising Deals by Round Types 2013-2018

In 2018, Israeli software company capital raising has grown more than 50% from 2015 and six-times from 2013. Thirteen mega software deals (above $50 million) over the past year totaled more than $1 billion. In Q4/2018, software companies raised $1.01 billion as a result of 19 large deals (above $20 million each).

In 2018, life sciences capital raising has kept stable levels, $1.2 billion in 126 deals. Medical devices companies attracted approximately 50% of the total sector capital. Deals over $20 million captured more than 70% of the total amount in this sector.

Fintech companies attracted the highest amounts in 2018 compare to 2013-2017 due to mega-deals: eToro ($100m), Next Insurance ($83m), and Hippo Insurance ($95m).

2018 was the strongest year for Israeli cyber security companies, which raised $1.08 billion in 89 deals, higher than 2017. Companies with AI characteristics continue the uptrend in valuation reaching $1.89 billion in 2018.

Marianna Shapira, research director at IVC Research Center points out: “2018 was a busy year for Israeli high-tech capital raising. Most of the capital was raised by well-established software companies with annual revenues of up to $10m in the verticals of AI and cyber security. The term ‘wealth attracts money’ describes the continued investment trend in Israel, as in the US. A number of other signs hint that the Israeli technology market will enter 2019 as an attractive target for global investments: more companies (43% of all active) have reached mature stages, a desirable goal for investors concentrating on quality rather than quantity.”

According to Shapira, foreign investors were more involved in the local venture market, boosting capital volume, as their average and follow-on investments increased: “In addition, as the number of seed transactions has grown in 2018, and venture capital allocation to current portfolios continues to flow, these major trends in Israeli high-tech capital raising will continue in the beginning of 2019.”

Investor’s Activity

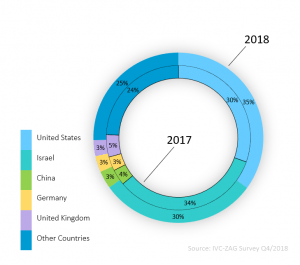

VC funds captured the largest investment share (34%) of total capital raised in 2018, reflecting a decrease compared to their historical share. Investment companies more than doubled the capital inflow compared with 2017. According to IVC’s data, the share of corporate VC capital investments has gradually grown over the years, reaching 9% of total capital invested in 2018, same as in 2017.

Shmulik Zysman, managing partner at Zysman, Aharoni, Gayer & Co. (ZAG/Sullivan): “The last quarter of 2018, in which high-tech companies in Israel raised $1.815 billion, a quarterly record sum, actually sums up the clear and consistent trend of Israeli high-tech—a consistent and steady rise for the last 6 years. Over the course of 2018, there was a noticeable trend of foreign funds and investors, whose investments in Israel rose by more than $1 billion compared to last year.”

According to Zysman: “A surprising and different factor is the trade war between China and the US: when those two are quarreling, Israeli companies are the ones that profit. Israeli high-tech companies have become the indirect route of Americans to China, and of the Chinese to the US.”

Zysman adds, that: “In recent years we have witnessed a decline in the share of seed and early stage companies in percentage of total investments in Israeli high-tech. Ostensibly, some will interpret this as a dangerous trend, since a tree will not grow without its roots; however, an in-depth analysis of this trend shows a steady increase of capital invested in these companies over the past six years. For example, the capital invested in these companies in 2018 is about 60% higher than the capital invested in early stages in 2013. In our view, this is excellent news.”

Israeli VC funds slowed their activity during 2018, both in new and follow-on investments. For the first time since 2013, the number of follow-on investments has exceeded the number of first investments for Israeli VCs. A slowdown was also noted in the relatively low share of Israeli VC funds compared to overall amounts—just 12%, the lowest in 6 years.

Chart 3: Capital Investments in Israeli High-Tech by Investor Country 2018 vs. 2017

Methodology

This report reviews capital raised by Israeli high-tech companies from Israeli and foreign venture capital funds as well as other investors, such as investment companies, corporate investors, incubators and angels. The report is based on data from 516 investors of which 59 were Israeli VC funds and 457 were other entities. The report data has last update at December 25, 2018.

The report covered total capital raised in the Israeli high-tech sector, including VC-backed rounds, where at least one VC fund participated in the round, as well as deals not backed by venture capital funds. The report includes amounts received by each company directly and does not count direct transactions performed between company shareholders. Each company belongs to more than one cluster, therefore the data regarding clusters should be viewed separately per cluster. For more on our methodology, please click here. For the full survey, please click here.

For additional information:

Marianna Shapira, Research Director, IVC +972-73-212-2339 marianna@ivc-online.com.

About the authors of this report:

IVC Research Center is the leading online provider of data and analyses on Israel’s high-tech, venture capital, and private equity industries. Its information is used by all key decision-makers, strategic and financial investors, government agencies, and academic and research institutions in Israel.

IVC-Online Database (www.ivc-online.com) showcases over 8,000 Israeli technology startups, and includes information on private companies, investors, venture capital and private equity funds, angel groups, incubators, accelerators, investment firms, professional service providers, investments, financings, exits, acquisitions, founders, key executives, and R&D centers.

Publications include newsletters; Daily Alerts; the IVC Magazine; surveys; research papers and reports; and interactive dashboards.

IVC Industry Analytics – analysis, research and insights into the status, main trends, and opportunities related to exits, investments, investors, sectors, and stages.

ZAG(Zysman, Aharoni, Gayer & Co.) is an international law firm with offices in Israel, the United States, China, and the United Kingdom. The firm’s attorneys specialize in all disciplines of commercial law for both publicly held and private companies, with particular expertise in hi-tech, life science, international transactions, and capital markets. ZAG-S&W provides result-driven legal and business advice to its clients, addressing all aspects of the clients’ business activities, including penetration into new markets in strategic locations. In recent years, the firm has acted on a majority of the equity and debt financing transactions by Israeli technology companies on the NASDAQ. It has been the firm’s experience that the best results, those that give our clients the competitive advantage they need, are attained by coupling professional experience, global presence, and connections with the investor communities in Israel and abroad.